So, how much revenue does this age group earn? American Express set out to answer that question and their results are astounding.

Almost one-third of parents (32%) indicate that their teens’ major source of income this season will be a summer job, according to the latest American Express Spending and Saving Tracker. And these are not unpaid summer internships: the 13-17 years olds, born in the nineties and leading the generation now referred to as “Generation Z”, are filling their piggy banks with hard-earned cash to the tune of $434 per month – approximately $1300 for the summer. While these 32% depend on their jobs as a primary source of income, many are still banking on parental support to fund their summer spending and saving.

In fact 38% of parents of these teens will dole out an allowance – at an average of $22i per week — as their kids’ primary income this summer. The majority of parents (70%) say the amount of the allowance will be determined by the chores their kids complete. And almost no one is getting away with bathing suits on the floor or towels left out of the hamper: 9 in 10 indicate that their kids will be responsible for chores this summer – paid and unpaid!

How to encourage Gen Z savings

I am a strong supporter of developing a good work ethic in children. One of the rules we had in our household was, if you don’t contribute to the chores you will be paying someone else to do it. So we were quick to reduce weekly allowance by unpaid chores with some of the kids picking up some additional cash. The cause and effect was immediate lending credence to the work motto, “you snooze, you lose.”

In addition to summer jobs and allowance, 11% of Gen Z will primarily rely on their savings this summer, parents report, while 6% will earn money from (non-steady) odd jobs such as helping out their grandparents or neighbors.

“No matter how they earn their income, the summer is a great time for parents and kids to discuss real-time strategies for spending and saving their money,” says David Kroner, SVP, Proprietary Products, American Express.

Summer income

| Teens Go Back to Basics to Earn Their Summer Stash |

| So how are Gen Z’s leaders—whose primary income is a summer job—earning their green? Below are the top five teen jobs this summer, by the numbers: |

| 1. Babysitting/nanny (18%) |

| 2. Fast food service (18%) |

| 3. Landscaping (13%) |

| 4. Working for family business (8%) |

| 5. Grocery store (8%) |

Family chores

| The More Things Change, The More Chores Stay the Same |

| Kids aged 6 to 17 may be savvier than their parents on all things digital, but you can’t get any more basic than mastering household chores. Gen Z—and their parents—keep to tried and true tasks. The top chores we can expect from kids this summer are: |

| 1. Cleaning their room (87%) |

| 2. Taking out the trash (61%) |

| 3. Doing dishes (56%) |

| 4. Caring for a pet (49%) |

| 5. Doing laundry (36%) |

The American Express Spending & Saving Tracker research was completed online among a random sample of 2008 adults, including the general U.S. population, as well as two sub-groups—Affluents and Families. Interviewing was conducted by Echo Research between June 5 and 8, 2012. Overall the results have a margin of error of ± 2.2 (or ± 3.9 among Affluents and ± 3.2 for families) percentage points at the 95% level of confidence. The results highlighted in this release are among parents with teenagers, age 13 to 17, (n=480) and have a margin of error of ± 4.5 percentage points at the 95% level of confidence.

Affluents are defined as having a minimum annual household income of $100,000. Families are defined as having children (under 18) in household.

Copyright TIGERS Success Series by Dianne Crampton

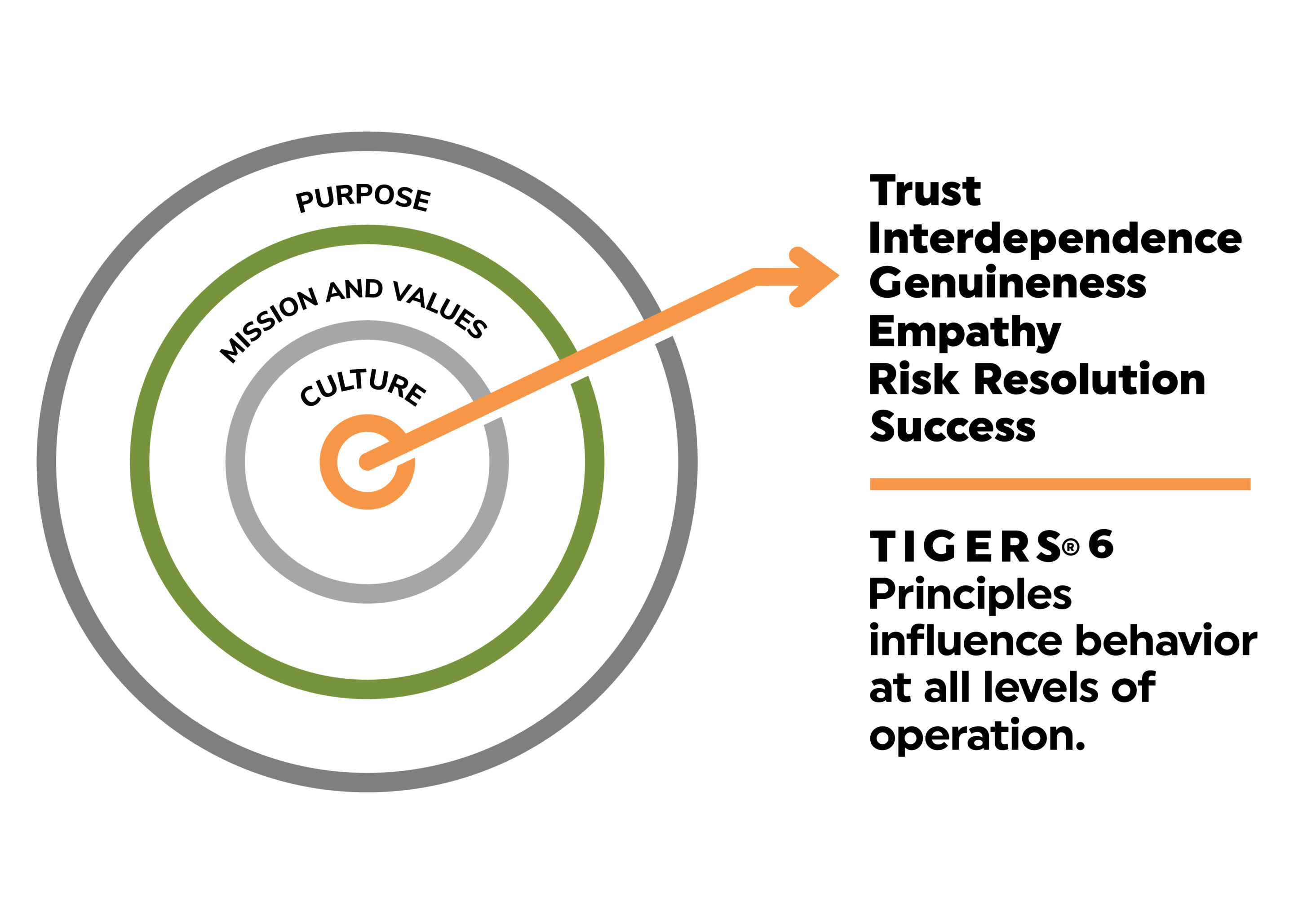

About the TIGERS 6 Principles

About the TIGERS 6 Principles

TIGERS® sets the standard for achieving a thriving, successful and collaborative team culture. TIGERS provides TIGERS Team Wheel Game and Facilitation Certification workshops for internal and external consultants, customized team building events, and leadership team development consulting and facilitation services. The goal is attaining optimum team performance – surprisingly fast.

About the TIGERS 6 Principles

About the TIGERS 6 Principles

Here is more information:

Young Americans Start Saving for Retirement 10 Years Earlier than Parents, Grandparents: Younger Generation Z Counting on Social Security, Inheritances to Fund Nest Egg

Giving the size of this age group, this is actually good news.

Nearly 60 percent of Gen X (59%) and Gen Y (56%) make regular, automatic contributions toward their retirement savings2, compared to 46 percent of non-retired Baby Boomers2. And when it comes to getting a jump on their nest egg, younger generations are eager to get started – both Gen X and Gen Y started saving for retirement, on average, in their mid- to late-twenties2. That’s nearly a decade earlier than Baby Boomers who, on average, stared saving at age 352.

“For even the most sophisticated investor, retirement planning can be a tough concept to grasp,” said Carrie Braxdale, managing director, investor services, TD Ameritrade, Inc., a broker dealer subsidiary of TD Ameritrade Holding Corporation. “Gen X and Y have accepted the reality of the past few years, and rather than being discouraged, they are using what they’ve witnessed to their advantage by saving earlier and regularly. The hope is that tomorrow’s investors, Gen Z, follow suit as they near retirement.”

For the teens and young adults of Generation Z (ages 13-22) who have grown up in households that struggled through the recession, the question remains as to whether they have been tainted by the gloom and doom or driven to be better. According to the survey, Gen Z generally understands the importance of saving money – over half (56%) said they have a savings account – thanks to the influence of early conversations about money with their parents1. But, those conversations have largely been about saving in general (82%) or saving for college (67%), rather than preparing for retirement (38%)1. Just eight percent of Gen Z reported they are currently saving money for their “golden years”1.

In fact, many Gen Z savers have a very different outlook on retirement saving strategies and timing when compared to their parents:

• Just 35 percent of Gen Z respondents believe they will not be able to count on Social Security when they retire, and therefore should save money for themselves, compared to 61 percent of Parents who reported the same1.

• Nearly 40 percent (39%) percent of Gen Z respondents believe they will have an inheritance, and therefore don’t need to worry about saving for retirement, compared to just 16 percent of Parents who reported that they believed the same for their Gen Z children1.

• Forty-three percent of Gen Z respondents believe that you can never start saving too early for retirement, compared to 71 percent of Parents who reported the same1.

“The good news is that Gen Z is starting off with a good understanding of the importance of saving,” said Braxdale. “But that doesn’t mean they should wait to become more educated on proper long-term savings habits. We encourage parents to talk to kids specifically about retirement savings to ensure they understand the importance of getting a head start and taking advantage of the power of compounding.”

TD Ameritrade’s website offers a number of free retirement planning resources that can help investors explore many of these questions — and more — including:

1. A “Cost of Waiting” Calculator that can help you understand why starting to save earlier is better in the long run

2. WealthRuler™ retirement calculator that can help you estimate your retirement readiness

3. Access to a network of knowledgeable, independent registered investment advisors (RIAs) through the TD Ameritrade AdvisorDirectTM program.