From cost-cutting to value-building, how CFOs shift their focus in the age of the Employee Stakeholder is an important key for stemming talent turnover. So, how did Jonathan achieve this?

In the bustling heart of a leading tech firm, CFO Jonathan Ellis faced a pivotal challenge. The company’s relentless focus on cost-cutting had alienated its workforce, turning the corridors of innovation into aisles of talent loss.

Recognizing the shift in corporate culture towards viewing employees as vital stakeholders, Jonathan embarked on a transformative financial journey. Gone were the days of seeing employees merely as line items on a spreadsheet; it was time to align financial strategies with human-centric values.

Jonathan introduced a new accounting framework that transcended traditional cost metrics. This innovative approach tracked not just financial efficiencies but also employee wellness trends that included overtime pay, scheduling conflicts, sick days and accidents. Added to this, he also added employee engagement and satisfaction trends. He implemented advanced analytics to monitor the impact of training programs, work-life balance initiatives, and career development opportunities on productivity and company loyalty. His trends identified shifts in improvement that could be quantified. This shift was more than numerical—it was cultural, fostering a sense of belonging and appreciation among the workforce – and talent gain.

The results were nothing short of groundbreaking. Employee turnover rates fell while innovation improved, catalyzing the firm’s growth and market position. Jonathan’s experience illustrates how transforming financial perspectives unlocks trackable trends with profound organizational benefit. Under his new accounting framework, the company not only boosted its financial health but also enriched its human capital, proving that when employees thrive, so does the business.

So where did Johnathan conceive of a shift in accounting approach to serve the concept of employee as stakeholder?

Harvard steps up to the plate with employee stakeholder rethinking

HBR often discusses the concept of treating employees as stakeholders within the broader framework of stakeholder capitalism and corporate social responsibility. This perspective emphasizes that employees, when considered as crucial stakeholders, are not just recipients of decisions but are active participants whose engagement can drive better business outcomes.

Past articles typically cover how this shift influences various aspects of business management, including strategic decision-making, leadership styles, and organizational culture. The focus is often on creating value that benefits not only shareholders but all stakeholders, which aligns with modern expectations of corporate responsibility and ethical business practices.

Engaging employees as stakeholders typically involves transparent communication, participative management styles, and policies that prioritize employee well-being and development. This approach can lead to higher job satisfaction, improved retention rates, and better overall company performance. Leadership is encouraged to consider the impacts of corporate decisions on their workforce and to foster a culture where employees’ contributions to corporate goals are recognized and rewarded. This is harder to justify when a CFO’s approach is basic cost accounting.

The impact of the paradigm shift from employee as cost to employee as stakeholder

The concept of treating employees as stakeholders in organizational success, as promoted by institutions like Harvard, significantly alters how workforce development initiatives are tracked and assessed. This is especially true in the CFO’s executive seat.

This paradigm shift moves beyond viewing employees merely as costs to be minimized on the profit and loss statement. It moves towards recognizing them as critical assets who contribute to long-term value creation.

There is a combination of three ways to satisfy employee and stakeholder value.

-

Financial tracking and reporting.

From a financial tracking and reporting perspective, the shift necessitates a more nuanced approach than traditional cost accounting methods. Employees as stakeholders imply an investment in human capital with expectations of returns through increased productivity, innovation, and corporate resilience. CFOs need to consider metrics such as return on investment (ROI) for training and development programs, which are more sophisticated than straightforward expense tracking. This could involve developing predictive analytics to correlate training investments with performance outcomes like higher sales, better customer satisfaction, and lower turnover rates. Such data-driven approaches help quantify the value of investing in employees, aligning financial strategies more closely with human resource development goals.

-

Integrated reporting frameworks

This shift also encourages the adoption of integrated reporting frameworks that include non-financial metrics such as employee engagement, skills development, and cultural alignment. These aspects are crucial for stakeholders who are interested not only in financial returns but also in sustainable business practices and corporate governance. CFOs might find themselves working more closely with HR to create a balanced scorecard that incorporates these broader indicators of organizational health and effectiveness.

-

Long-term value creation rather than short-term financial gains

In viewing employees as stakeholders, there is an increased emphasis on long-term value creation rather than short-term financial gains. This might lead to a shift in how financial outcomes are projected and reported. Trends like increased employee retention or improved organizational agility might be highlighted as key indicators of financial health, alongside more traditional financial metrics. This broader perspective could also influence how investments in workforce development are planned and executed, with a greater focus on continuous improvement and adaptation to future market needs.

Overall, the transition from seeing employees as mere costs to recognizing them as valuable stakeholders requires a more strategic and integrated approach to financial and workforce planning, significantly impacting how CFOs track, measure, and report on these initiatives.

This bodes well for the organizations and the communities they reside in as well. In regarding employees as stakeholders, there is an increased emphasis on long-term value creation rather than short-term financial gains. This might lead to a shift in how financial outcomes are projected and reported.

Where the TIGERS 6 Principles and other experts align with employee as stakeholder

Below are examples and links to other studies that shore up the trend line that things are changing for CEOs who want their companies to be in existence ten years from now on a global scale.

McKinsey & Company

In the evolving role of CFOs, especially concerning the view of employees as stakeholders, several key themes emerge. Themes reflect how this shift affects workforce development and the broader strategic orientation of financial leadership.

One significant trend is the increasing involvement of CFOs in areas traditionally outside the narrow financial scope, such as digital transformation and environmental, social, and governance (ESG) initiatives. This broader involvement suggests that CFOs are now expected to contribute to creating value beyond the immediate financial metrics, aligning closely with the idea of employees as key stakeholders whose development can drive organizational success. This includes a strategic shift towards investing in talent and technology that can enhance organizational capabilities and long-term competitiveness (McKinsey & Company)

Deloitte USA

CFOs are also adopting a more strategic role in their organizations, engaging as architects and transformers within the strategic planning process. This involves not just oversight of financial operations but active participation in shaping the company’s strategic direction. This shift indicates that CFOs are crucial in integrating financial strategies with overarching business goals, including talent management and development. This reflects an understanding of employees as stakeholders whose growth and satisfaction impact the company’s performance and resilience (an investment in human capital).

These transformations highlight a departure from viewing workforce development solely through a cost-management lens towards a more integrated approach where employee growth and engagement are seen as central to driving long-term value creation. This indicates a move towards more sophisticated metrics and analytics to assess the impact of workforce initiatives on organizational performance, suggesting a future where financial leadership aligns more closely with human resources to foster a workforce that can sustain and enhance the company’s strategic objectives.

Harvard

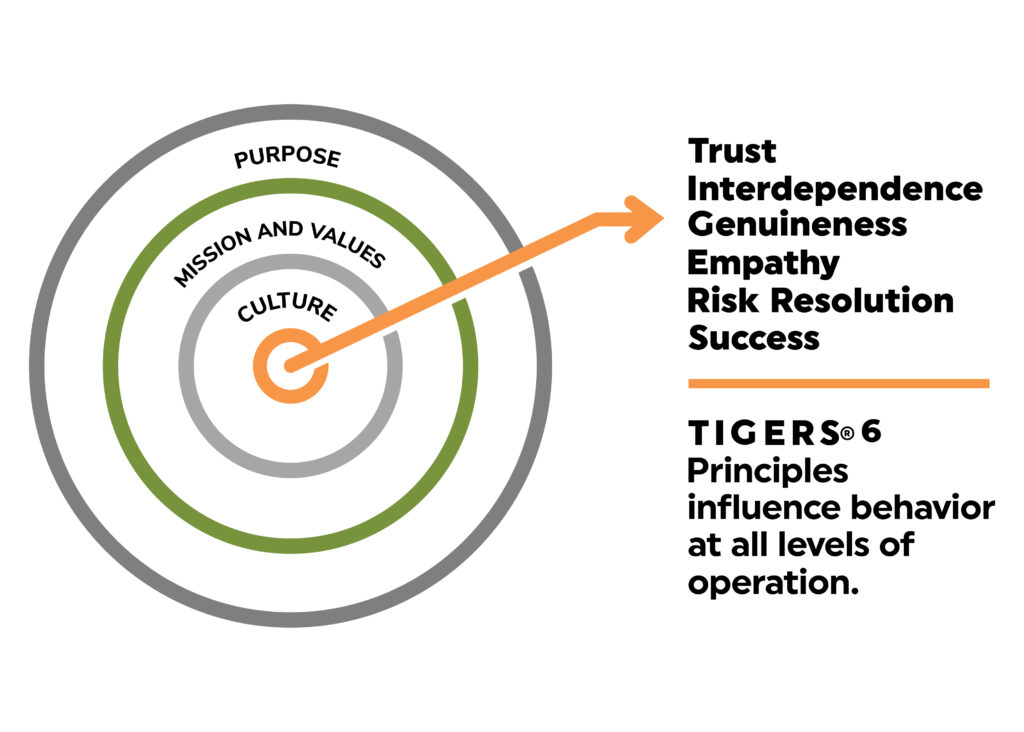

Harvard Business School has been discussing the concept of employees as stakeholders for several decades. More focused and formalized approaches emerged in recent years. This aligns with the broader discussions of stakeholder capitalism and corporate governance mentioned previously. These discussions have intensified as part of a global shift. The shift is towards more inclusive business models like the TIGERS 6 Principles that consider a wider array of stakeholder needs and organizational behavior beyond just shareholders.

The Harvard HR Management Model, for example, emphasizes balancing the interests of various stakeholders, including employees, in the development of Human Resource Management (HRM) policies. This model integrates stakeholder interests into all aspects of HRM. Examples include recruitment, training, performance management, and compensation. These interests ensure that the needs of employees as key stakeholders are considered in shaping a fair and inclusive workplace environment (HRM Guide).

Additionally, the growing acceptance of stakeholder governance in the corporate world has been mirrored in academic discussions. Harvard publications I track examine how companies integrate Environmental, Social, and Governance (ESG) considerations into their business strategies. These discussions highlight the importance of including employees among the key stakeholders who influence and benefit from a company’s long-term sustainability strategies (HRM Guide).

These perspectives are part of a broader recognition of the importance of treating employees not merely as resources but as central contributors to and beneficiaries of corporate success. This aligns with modern ESG and stakeholder governance principles. This approach not only enhances company resilience and adaptability but also aligns corporate strategies with the broader societal values of equity, inclusion, and sustainability.

Measuring and identifying the root cause of talent turnover in your organization

Workforce behavior significantly impacts talent retention, with positive environments fostering lower turnover rates and vice versa. When employees feel valued, supported, and engaged, they are more likely to remain with an organization, driving down recruitment and training costs associated with high turnover. Conversely, poor management behavior that is untrustworthy, internally competitive rather than interdependent, disingenuous, non empathic, non risk resolving and unsuccessful due to lack of employee recognition and limited growth opportunities increases dissatisfaction and drives talent away. This turnover not only incurs direct costs but also affects team morale and productivity, potentially harming the company’s long-term viability.

The TIGERS Workforce Behavioral Profile™ 360 Assessment offers a strategic tool for CFOs who are transitioning from traditional cost metrics to a more holistic approach that views employees as crucial stakeholders. This behavioral assessment framework helps identify the core principles and behaviors that promote effective teamwork and organizational compatibility. By understanding and nurturing these dynamics, CFOs can enhance employee engagement and job satisfaction, directly contributing to lower turnover rates and fostering a more stable and productive workforce environment.

For a CFO and executive team that has identified an employee-as-stakeholder culture for corporate transformation, integrating tools like the TIGERS Workforce Behavioral Profile means moving beyond the numbers to consider the qualitative aspects of workforce management. This approach aligns financial strategies with workforce well-being, acknowledging that financial health is deeply interconnected with employee satisfaction and retention.

Such a shift not only benefits the company’s culture but also strengthens its competitive edge by building a resilient, committed, and highly motivated workforce. This strategic alignment, driven by a forward-thinking CFO and executive team, ultimately leads to sustainable growth and success, proving that when companies invest in their people, the returns extend beyond mere profits to long term growth and sustainability.

Copyright TIGERS Success Series, Inc. by Dianne Crampton

The TIGERS 6 Principles empower Executives and Consultants with a comprehensive collaborative work culture and leadership platform to resolve avoidable talent, engagement and work community problems that stunt growth.

A researched and validated collaborative work culture and facilitative leadership model, licensing is available for HR Executives, Operations and Project Managers, Consultants and Coaches to improve their operations and client success.

Schedule a call to secure a tour of the comprehensive TIGERS 6 Principles system.

Want more tips like these? Receive our newsletter to have insights delivered right to your mailbox.